DECOLGEN is the market leader in the cold & flu, adult category with 13% value market share, but following closely behind are players such as Tiffy (Thai Nakorn), Panadol Cold (GSK) and Flu (Green Panadol) and Hapacol Cold and Flu products (several SKUs of Hapacol Cảm Cúm & Coldacmin Flu) from DHG.

In 2022, DECOLGEN need to develop an impact TV strategy to win TIFFY across regions and keep strong brand position in consumer mind.

The challenge of brand: Limited budget compared to high investment of TIFFY on TV ads especially in the NORTH

Reach ~70% core target audience group.

Achieved 45% SOV after 2 bursts at 37% SOS level.

Saving 22% investment due to FOC value (free spot, PPIB…).

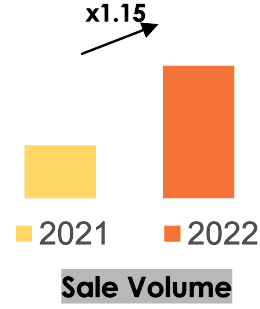

Sale volume up to ~ 1.5 times vs. last year